Comparing Business Loans: Miami vs. New York

Understanding the Landscape of Business Loans

When it comes to securing a business loan, location can play a significant role in the options available to you. Miami and New York, two bustling hubs of commerce, each offer unique opportunities and challenges for entrepreneurs seeking financing. In this post, we'll explore the differences in business loan offerings between these two cities, helping you make an informed decision on where to establish or expand your business.

Both Miami and New York have thriving business ecosystems, but they cater to different industries and business needs. Miami is known for its vibrant tourism and real estate sectors, while New York is a powerhouse in finance and technology. Understanding these nuances is crucial when navigating the business loan landscape in each city.

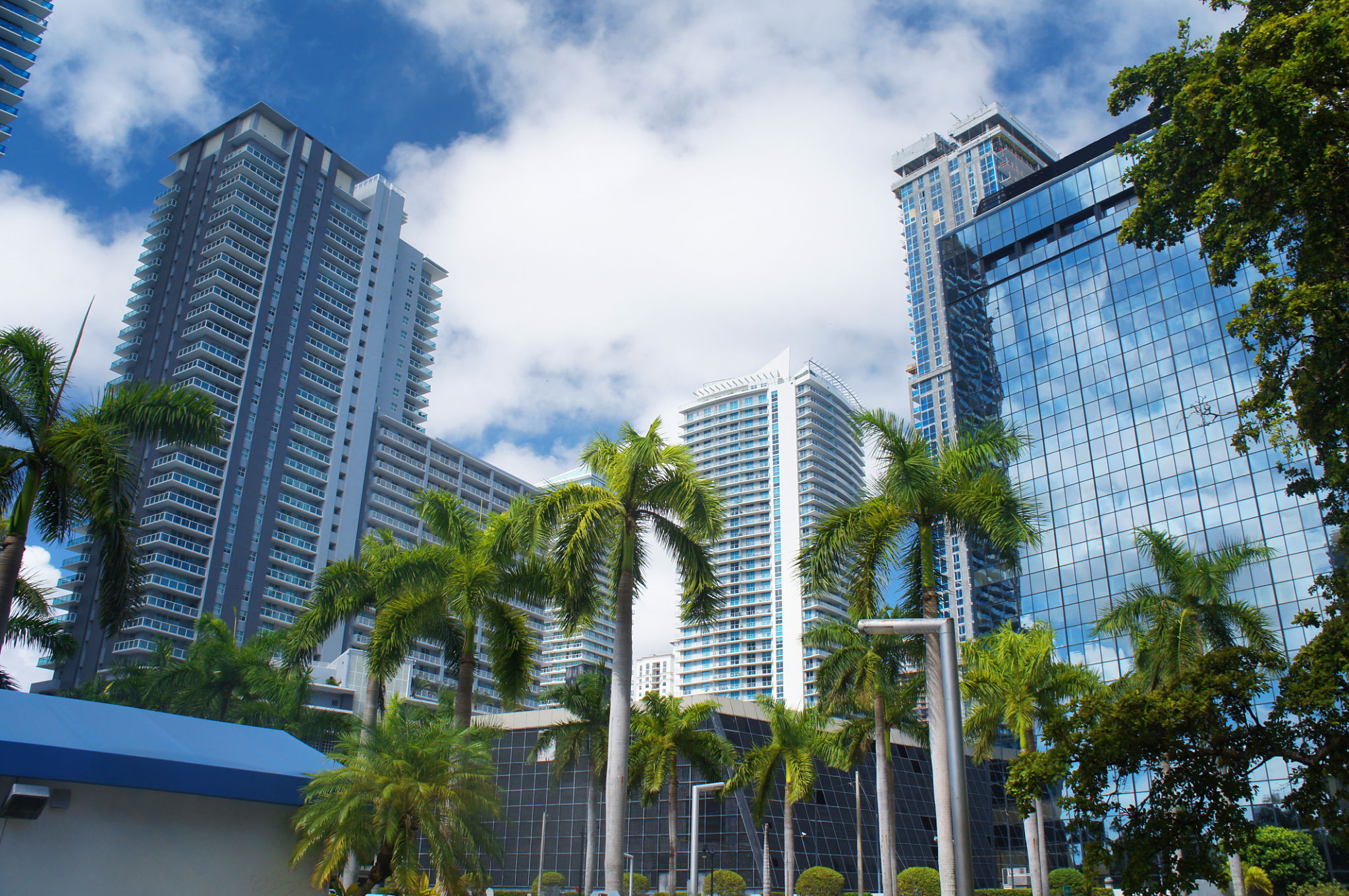

Miami: A Hub for Diverse Business Opportunities

Miami offers a dynamic environment for entrepreneurs, especially those in hospitality, real estate, and international trade. The city's strategic location as a gateway to Latin America makes it an attractive destination for businesses targeting international markets. Consequently, local lenders often provide loans tailored to these sectors, with competitive interest rates and flexible terms.

One of the key benefits of securing a business loan in Miami is the availability of government-backed programs aimed at supporting small businesses. The Miami-Dade County offers various incentives and grants to foster growth, making it easier for startups and small enterprises to access necessary funding.

Types of Loans Available in Miami

In Miami, business owners can explore a variety of loan options, including:

- SBA Loans: Backed by the Small Business Administration, these loans are popular for their favorable terms.

- Commercial Real Estate Loans: Ideal for businesses looking to invest in property within the booming real estate market.

- Microloans: Smaller loans for startups needing modest capital infusion.

New York: The Financial Powerhouse

New York City, with its towering skyscrapers and bustling streets, is synonymous with financial prowess. As a global financial hub, it offers a wide array of loan products catering to various industries, particularly finance and technology. Entrepreneurs in New York have access to some of the most competitive loan terms due to the city's high density of financial institutions.

However, the competitive nature of New York's market can also mean stricter lending criteria. Lenders often require strong credit scores and detailed business plans before approving a loan application. Despite this, the potential for high returns in New York's diverse economy continues to attract ambitious entrepreneurs.

Loan Options in New York

New York offers a multitude of financing solutions, including:

- Venture Capital: For businesses with high growth potential, venture capital can provide substantial funding.

- Lines of Credit: Flexible borrowing options are available for managing cash flow fluctuations.

- Traditional Bank Loans: Larger institutions offer conventional loans with competitive rates.

Comparing Costs and Benefits

The cost of securing a business loan varies significantly between Miami and New York. In Miami, the cost of living and doing business is generally lower compared to New York, which can translate into more affordable loan terms. However, New York's extensive network of lenders can provide more options and potentially better opportunities for those who meet their criteria.

Ultimately, the decision between Miami and New York should be based on your business's specific needs and goals. Consider factors such as industry focus, market potential, and personal preferences to determine which city aligns best with your vision.